CPA Regulation (REG) 2024 Practice Test

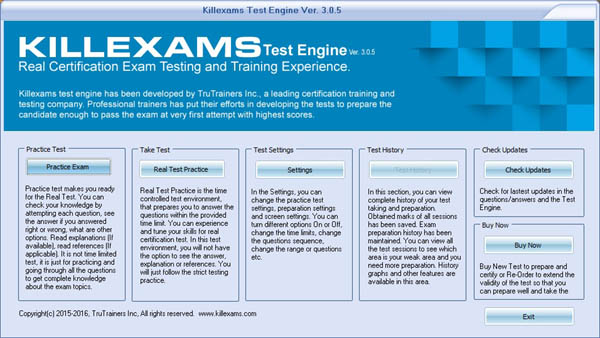

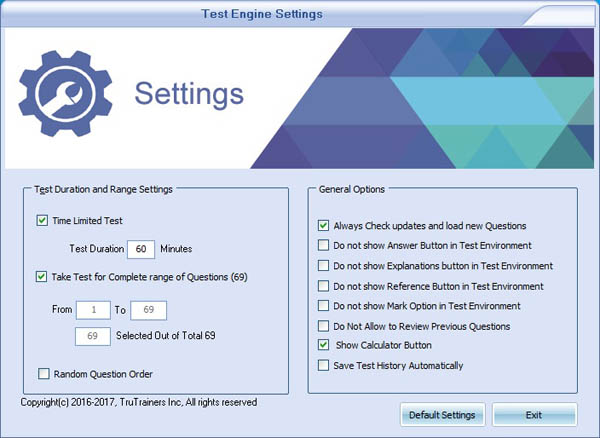

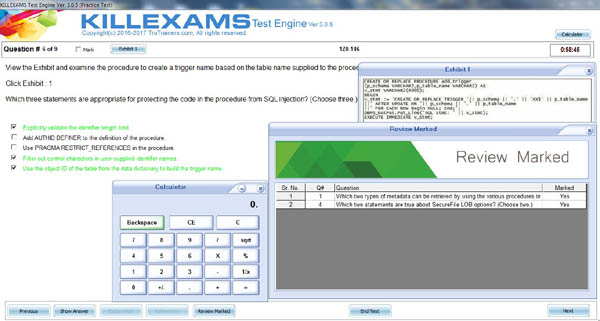

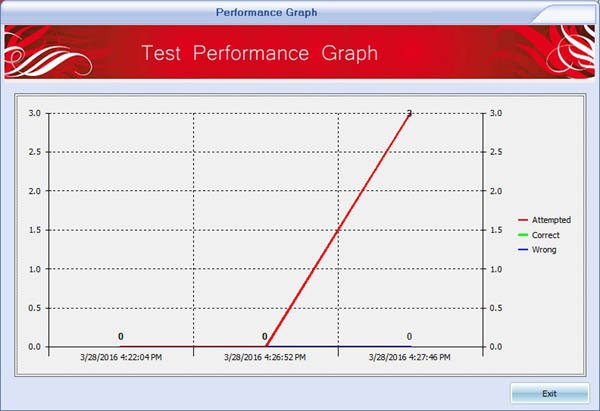

Pass4sure CPA-REG practice test contains complete question pool, updated in January 2025 including VCE exam simulator that will help you get high marks in the exam. All these CPA-REG exam questions are verified by killexams certified professionals and backed by 100% money back guarantee.

AICPA CPA-REG : CPA Regulation (REG) 2024 Practice TestsPractice Tests Organized by Martin Hoax |

Latest 2025 Updated AICPA CPA Regulation (REG) 2024 Syllabus

CPA-REG examcollection with Premium PDF and Test Engine

Practice Tests and Free VCE Software - Questions Updated on Daily Basis

Big Discount / Cheapest price & 100% Pass Guarantee

CPA-REG examcollection : Download 100% Free CPA-REG practice questions (PDF and VCE)

Exam Number : CPA-REG

Exam Name : CPA Regulation (REG) 2024

Vendor Name : AICPA

Update : Click Here to Check Latest Update

Question Bank : Check Questions

Download todays updated CPA-REG Cram Guide with Practice Test

Killexams.com provides the latest and up-to-date practice questions with actual CPA-REG Latest Questions and Answers for new Topics of AICPA CPA-REG Exam. Practice our CPA-REG Free exam PDF and Answers to Boost your understanding and pass your CPA Regulation (REG) 2024 test with high marks. We certain your success in the Test Center, covering all the points of CPA-REG test and enhancing your knowledge of the CPA-REG exam. Pass with our actual CPA-REG questions.

When it comes to finding CPA-REG quiz test online, there are countless suppliers to choose from, but unfortunately most of them are selling outdated material. To ensure you are getting the most reliable and trustworthy CPA-REG quiz test provider on the web, we recommend turning to killexams.com. However, it's important to keep in mind that your research should not end up being a waste of time and money. To get started, visit killexams.com and obtain 100% free CPA-REG sample questions to assess the quality of our material. If you are satisfied, sign up for a three-month account to obtain the latest and most valid CPA-REG quiz test that include real test questions and answers. Plus, take advantage of our great discount coupons and don't forget to obtain CPA-REG VCE test simulator for practice.

By copying CPA-REG quiz test PDF onto any device, you can study and memorize the real CPA-REG questions while on vacation or traveling. This will save you a lot of time and give you more opportunity to study CPA-REG questions. Practice CPA-REG quiz test with VCE exam simulator over and over again until you score 100%. Once you feel confident, head straight to the Exam Center for the real CPA-REG exam.

In 2025, there were many changes and improvements made to CPA-REG and we have incorporated all the updates in our boot camp. Our 2025 updated CPA-REG braindumps ensure your success in the actual exam. We recommend going through the full examcollection at least once before taking the real test. This is not only because people who use our CPA-REG quiz test feel an improvement in their knowledge, but also because they can work in a real environment within the organization as experts. We don't just focus on passing CPA-REG exam with braindumps, but truly aim to Boost understanding of CPA-REG subjects and objectives. This is how individuals become successful.

CPA-REG exam Format | CPA-REG Course Contents | CPA-REG Course Outline | CPA-REG exam Syllabus | CPA-REG exam Objectives

Content area allocation Weight

I. Ethics, Professional Responsibilities and Federal Tax Procedures 10–20%

II. Business Law 10–20%

III. Federal Taxation of Property Transactions 12–22%

IV. Federal Taxation of Individuals 15–25%

V. Federal Taxation of Entities 28–38%

minutes — Welcome/enter launch code

5 minutes — Confidentiality/section information

4 hours — Testing time

15 minutes — Break after third testlet (option to pause exam timer)

5 minutes — Survey

Each of the four exam sections is broken down into five smaller sections called testlets. These testlets feature multiple-choice questions (MCQs) and task-based simulations (TBSs). In the case of BEC, you also have to complete three written communication tasks. The number of MCQs and TBSs tested varies depending upon the specific section taken. You will receive at least one research question (research-oriented TBS) in the AUD, FAR and REG sections. To complete them, you will have to search the related authoritative literature and find an appropriate reference.

The REG section blueprint is organized by content AREA, content GROUP

and content TOPIC. Each subject includes one or more representative TASKS

that a newly licensed CPA may be expected to complete when performing tax

preparation services, tax advisory services or other responsibilities of a CPA.

The tasks in the blueprint are representative. They are not intended to be (nor

should they be viewed as) an all-inclusive list of tasks that may be tested in the

REG section of the Exam. Additionally, it should be noted that the number of

tasks associated with a particular content group or subject is not indicative of the

extent such content group, subject or related skill level will be assessed on the

Exam. Similarly, examples provided within the task statements should not be

viewed as all-inclusive.

Area I Ethics, Professional Responsibilities and

Federal Tax Procedures 10–20%

Area II Business Law 10–20%

Area III Federal Taxation of Property Transactions 12–22%

Area IV Federal Taxation of Individuals 15-25%

Area V Federal Taxation of Entities 28-38%

Overview of content areas

Area I of the REG section blueprint covers several topics, including the following:

• Ethics and Responsibilities in Tax Practice – Requirements based on Treasury

Department Circular 230 and the rules and regulations for tax return preparers

• Licensing and Disciplinary Systems – Requirements of state boards of

accountancy to obtain and maintain the CPA license

• Federal Tax Procedures – Understanding federal tax processes and

procedures, including appropriate disclosures, substantiation, penalties and

authoritative hierarchy

• Legal Duties and Responsibilities – Understanding legal issues that affect

the CPA and his or her practice

Area II of the REG section blueprint covers several Topics of Business Law,

including the following:

• Knowledge and understanding of the legal implications of business

transactions, particularly as they relate to accounting, auditing and financial

reporting.

• Areas of agency, contracts, debtor-creditor relationships, government

regulation of business, and business structure.

- The Uniform Commercial Code under the Topics of contracts and

debtor-creditor relationships.

- Nontax-related business structure content. Area V of the REG section

blueprint covers the tax-related issues of the various business structures.

• Federal and widely adopted uniform state laws and references as identified

in References below.

Area III, Area IV and Area V of the REG section blueprint cover various topics

of federal income taxation and gift and estate tax. Accounting methods and

periods, and tax elections are included in the Areas listed below:

• Area III covers the federal income taxation of property transactions. Area III

also covers Topics related to federal estate and gift taxation.

• Area IV covers the federal income taxation of individuals from both a tax

preparation and tax planning perspective.

• Area V covers the federal income taxation of entities including sole

proprietorships, partnerships, limited liability companies, C corporations,

S corporations, joint ventures, trusts, estates and tax-exempt organizations,

from both a tax preparation and tax planning perspective.

Section assumptions

The REG section of the exam includes multiple-choice questions,

task-based simulations and research prompts. Candidates should assume

that the information provided in each question is material and should apply

all stated assumptions. To the extent a question addresses a subject that could

have different tax treatments based on timing (e.g., alimony arrangements

or net operating losses), it will include a clear indication of the timing (e.g.,

use of real dates) so that the candidates can determine the appropriate

portions of the Internal Revenue Code or Treasury Regulations to apply to

Remembering and understanding is mainly concentrated in Area I and Area II.

These two areas contain the general ethics, professional responsibilities and

business law knowledge that is required for newly licensed CPAs and is tested

at the lower end of the skill level continuum.

• Application and analysis skills are primarily tested in Areas III, IV and V. These

three areas contain more of the day-to-day tasks that newly licensed CPAs are

expected to perform and therefore are tested at the higher end of the skill level

continuum.

The representative tasks combine both the applicable content knowledge and

the skills required in the context of the work that a newly licensed CPA would

reasonably be expected to perform. The REG section does not test any content at

the Evaluation skill level as newly licensed CPAs are not expected to demonstrate

that level of skill in regards to the REG content.

1. Regulations

governing

practice

before the Internal Revenue Service

Recall the regulations governing practice before the Internal Revenue Service.

Apply the regulations governing practice before the Internal Revenue Service given a specific scenario.

2. Internal Revenue

Code and

Regulations

related

to tax return

preparers

Recall who is a tax return preparer.

Recall situations that would result in federal tax return preparer penalties.

Apply potential federal tax return preparer penalties given a specific scenario.

B. Licensing and disciplinary systems

Understand and explain the role and authority of state boards of accountancy.

C. Federal tax procedures

1. Audits, appeals

and judicial

process

Explain the audit and appeals process as it relates to federal tax matters.

Explain the different levels of the judicial process as they relate to federal tax matters.

Identify options available to a taxpayer within the audit and appeals process given a specific

scenario.

Identify options available to a taxpayer within the judicial process given a specific scenario.

2. Substantiation

and disclosure

of tax positions

Summarize the requirements for the appropriate disclosure of a federal tax return

position.

Identify situations in which disclosure of federal tax return positions is required.

Identify whether substantiation is sufficient given a specific scenario.

3. Taxpayer penalties Recall situations that would result in taxpayer penalties relating to federal tax returns.

Calculate taxpayer penalties relating to federal tax returns.

4. Authoritative

hierarchy

Recall the appropriate hierarchy of authority for federal tax purposes.

D. Legal duties and responsibilities

1. Common law

duties and

liabilities to

clients and third

parties

Summarize the tax return preparers common law duties and liabilities to clients and

third parties.

Identify situations which result in violations of the tax return preparers common law duties

and liabilities to clients and third parties.

2. Privileged

communications,

confidentiality

and privacy acts

Summarize the rules regarding privileged communications as they relate to tax practice.

Identify situations in which communications regarding tax practice are considered

privileged.

1. Authority of agents

and principals Recall the types of agent authority.

Identify whether an agency relationship exists given a specific scenario.

2. Duties and

liabilities of agents

and principals

Explain the various duties and liabilities of agents and principals.

Identify the duty or liability of an agent or principal given a specific scenario.

B. Contracts

1. Formation Summarize the elements of contract formation between parties.

Identify whether a valid contract was formed given a specific scenario.

Identify different types of contracts (e.g., written, verbal, unilateral, express and implied)

given a specific scenario.

2. Performance Explain the rules related to the fulfillment of performance obligations necessary for an

executed contract.

Identify whether both parties to a contract have fulfilled their performance obligation given

a specific scenario.

3. Discharge, breach

and remedies

Explain the different ways in which a contract can be discharged (e.g., performance,

agreement and operation of the law).

Summarize the different remedies available to a party for breach of contract.

Identify situations involving breach of contract.

Identify whether a contract has been discharged given a specific scenario.

Identify the remedy available to a party for breach of contract given a specific scenario.

C. Debtor-creditor relationships

1. Rights, duties

and liabilities of

debtors,

creditors

and guarantors

Explain the rights, duties and liabilities of debtors, creditors and guarantors.

Identify rights, duties or liabilities of debtors, creditors or guarantors given a specific

scenario.

2. Bankruptcy and

insolvency

Explain the rights of the debtors and the creditors in bankruptcy and insolvency.

Summarize the rules related to the different types of bankruptcy.

Explain discharge of indebtedness in bankruptcy.

Identify the rights of the debtors and the creditors in bankruptcy and insolvency given a

specific scenario.

Identify the type of bankruptcy described in a specific scenario.

3. Secured

transactions

Explain how property can serve as collateral in secured transactions.

Summarize the priority rules of secured transactions.

Explain the requirements needed to create and perfect a security interest.

Identify the prioritized ordering of perfected security interests given a specific scenario.

Identify whether a creditor has created and perfected a security interest given a

specific scenario.

D. Government regulation of business

1. Federal securities

regulation

Summarize the various securities laws and regulations that affect corporate governance

with respect to the federal Securities Act of 1933 and federal Securities Exchange Act

of 1934.

Identify violations of the various securities laws and regulations that affect corporate

governance with respect to the federal Securities Act of 1933 and federal Securities

Exchange Act of 1934.

2. Other federal

laws and

regulations

(e.g., employment

tax, qualified health

plans and worker

classification)

Summarize federal laws and regulations, for example, employment tax, qualified health plans

and worker classification federal laws and regulations.

Identify violations of federal laws and regulations, for example, employment tax, qualified

health plans and worker classification federal laws and regulations.

1. Selection and

formation of

business entity

and related

operation

and termination

Summarize the processes for formation and termination of various business entities.

Summarize the non-tax operational features for various business entities.

Identify the type of business entity that is best described by a given set of

nontax-related characteristics.

2. Rights, duties,

legal obligations

and authority

of owners and

management

Summarize the rights, duties, legal obligations and authority of owners and management.

Identify the rights, duties, legal obligations or authorities of owners or management given a

specific scenario.

1. Basis and holding

period of assets

Calculate the tax basis of an asset.

Determine the holding period of a disposed asset for classification of tax gain or loss.

2. Taxable and

nontaxable

dispositions

Calculate the realized and recognized gain or loss on the disposition of assets for federal income

tax purposes.

Calculate the realized gain, recognized gain and deferred gain on like-kind property exchange

transactions for federal income tax purposes.

Analyze asset sale and exchange transactions to determine whether they are taxable or

nontaxable.

3. Amount and

character of gains

and losses, and

netting process

(including

installment sales)

Calculate the amount of capital gains and losses for federal income tax purposes.

Calculate the amount of ordinary income and loss for federal income tax purposes.

Calculate the amount of gain on an installment sale for federal income tax purposes.

Review asset transactions to determine the character (capital vs. ordinary) of the gain or

loss for federal income tax purposes.

Analyze an agreement of sale of an asset to determine whether it qualifies for installment

sale treatment for federal income tax purposes.

4. Related party

transactions

(including imputed

interest)

Recall related parties for federal income tax purposes.

Recall the impact of related party ownership percentages on acquisition and disposition

transactions of property for federal income tax purposes.

Calculate the direct and indirect ownership percentages of corporation stock or partnership

interests to determine whether there are related parties for federal income tax purposes.

Calculate a taxpayers basis in an asset that was disposed of at a loss to the taxpayer by a

related party.

Calculate a taxpayers gain or loss on a subsequent disposition of an asset to an unrelated

third party that was previously disposed of at a loss to the taxpayer by a related party.

Calculate the impact of imputed interest on related party transactions for federal

tax purposes.

B. Cost recovery (depreciation, depletion and amortization)

Calculate tax depreciation for tangible business property and tax amortization of intangible

assets.

Calculate depletion for federal income tax purposes.

Compare the tax benefits of the different expensing options for tax depreciation for federal

income tax purposes.

Reconcile the activity in the beginning and ending accumulated tax depreciation account.

1. Transfers subject

to gift tax Recall transfers of property subject to federal gift tax.

Recall whether federal Form 709 — United States Gift (and Generation-Skipping Transfer)

Tax Return is required to be filed.

Calculate the amount and classification of a gift for federal gift tax purposes.

Calculate the amount of a gift subject to federal gift tax.

2. Gift tax annual

exclusion and gift

tax deductions

Recall allowable gift tax deductions and exclusions for federal gift tax purposes.

Recall situations involving the gift tax annual exclusion, gift-splitting and the impact on

the use of the lifetime exclusion amount for federal gift tax purposes.

Compute the amount of taxable gifts for federal gift tax purposes.

3. Determination

of taxable estate

Recall assets includible in a decedents gross estate for federal estate tax purposes.

Recall allowable estate tax deductions for federal estate tax purposes.

Calculate the taxable estate for federal estate tax purposes.

Calculate the gross estate for federal estate tax purposes.

Calculate the allowable estate tax deductions for federal estate tax purposes

Calculate the amounts that should be included in, or excluded from, an individuals gross

income as reported on federal Form 1040 — U.S. Individual Income Tax Return.

Analyze projected income for use in tax planning in future years.

Analyze client-provided documentation to determine the appropriate amount of gross

income to be reported on federal Form 1040 — U.S. Individual Income Tax Return.

B. Reporting of items from pass-through entities

Prepare federal Form 1040 — U.S. Individual Income Tax Return based on the information

provided on Schedule K-1.

C. Adjustments and deductions to arrive at adjusted gross income and taxable income

Calculate the amount of adjustments and deductions to arrive at adjusted gross income

and taxable income on federal Form 1040 — U.S. Individual Income Tax Return.

Calculate the qualifying business income (QBI) deduction for federal income tax purposes.

Analyze client-provided documentation to determine the validity of the deductions

taken to arrive at adjusted gross income or taxable income on federal Form 1040 — U.S.

Individual Income Tax Return.

D. Passive activity losses (excluding foreign tax credit implications)

Recall passive activities for federal income tax purposes.

Calculate net passive activity gains and losses for federal income tax purposes.

Prepare a loss carryforward schedule for passive activities for federal income tax purposes.

Calculate utilization of suspended losses on the disposition of a passive activity for

federal income tax purposes.

Uniform CPA exam Blueprints: Regulation (REG) REG16

Regulation (REG)

Area IV – Federal Taxation of Individuals

Killexams Review | Reputation | Testimonials | Feedback

I need actual test questions for the CPA-REG exam.

Thanks to killexams.com, I was able to pass the CPA-REG exam with a strong score. The exam was tough, but their questions were easy to memorize and actual. I credit killexams.com for providing me with the knowledge I needed to pass the exam.

Updated and reliable practice questions for CPA-REG are available here.

I recently passed the CPA-REG exam with the help of killexams.com. This bundle is an incredible solution if you need brief yet reliable training for the CPA-REG exam. As far as exam simulations go, killexams.com is the winner. Their exam simulator surely simulates the exam, including the particular query sorts. It made things less complicated, and in my case, I consider it contributed to me getting 100% marks! I could not believe my eyes! I knew I did well, but this was a surprise.

What excellent CPA-REG questions work in the real exam!

I am happy to inform you that I passed the CPA-REG exam the other day. I could not have done it without the help of killexams.com questions, answers, and exam simulator, with only a week of preparation. The CPA-REG questions are real, and this is exactly what I saw in the test center. Moreover, this prep corresponds with all the key issues of the CPA-REG exam, so I was fully prepared for a few questions that were slightly different from what killexams.com provided, yet on the same topic. However, I passed CPA-REG and am happy about it.

Proper knowledge and study with the CPA-REG Dumps and practice tests! What a combination!

I had an excellent experience with killexams.com practice test, and I managed to score 97% marks after just two weeks of preparation. As a working mom with limited time, I needed authentic materials to prepare for the CPA-REG exam. killexams.com practice test were the right selection, and I am grateful to my parents for arranging the materials and supporting me in passing the exam.

Save your time and money; read these CPA-REG Dumps and take the exam.

I am Aggarwal, and I work for Clever Corp. I was thinking about the CPA-REG exam because it contained hard case memorization. I implemented killexams.com questions and answers, and my many doubts got cleared because of the explanations provided for the answers. I also received well-solved case memorization in my email. I am happy to mention that I got 73% in the exam, and I credit killexams.com for helping me succeed.

AICPA 2024 PDF questions

CPA-REG Exam

User: Konstant*****

Thanks to the Killexams.com practice tests, I was able to pass the cpa-reg exam with ease. They quickly alleviated any doubts I had about the exam and provided all the necessary materials to succeed. This was the first time in my career that I attended an exam with such confidence and passed with flying colors. I am grateful for the outstanding help provided by Killexams.com. |

User: Pat*****

While having a sharp mind is important for success in the CPA REGULATION (REG) 2024 exam, having a knowledgeable and certified instructor is equally crucial. I was fortunate to have found killexams.com, where I met excellent educators who provided me with the necessary guidance to pass my exam with ease. I am truly grateful for their support and dedication. |

User: Misha*****

I am delighted to share my experience with killexams.com, as it has helped me achieve my dream of passing the cpa-reg exam. With this certification, I am now qualified for higher job positions and can choose a better career path. This opportunity was something I could not even imagine a few years ago. Although the cpa-reg exam and certification are specific to cpa-reg, I discovered that other employers are also interested in candidates who have passed this exam, as it proves their excellent skills. The killexams.com cpa-reg guidance package helped me answer most questions correctly, covering all Topics and regions. Some cpa-reg product questions are tricky, but with killexams.com, I was able to get the maximum number of questions right. |

User: Lucía*****

Even though I had a full-time job and family responsibilities, I decided to take the cpa-reg exam. I needed a quick and easy strategy for studying, and I found it in Killexams.com Questions and Answers. The concise answers were easy to remember, and I am thankful for the guidance. |

User: Lewis*****

The Dumps provided by Killexams.com helped me understand what was expected in the cpa-reg exam. I prepared in just 10 days and finished all the questions of the exam in eighty minutes. The material covered the exam subject matter and helped me memorize all the Topics accurately. It also taught me how to manage my time to finish the exam before time. It is an excellent preparation technique. |

CPA-REG Exam

| Question: Does killexams verify the answers? Answer: Killexams has its certification team that keeps on reviewing the documents to verify the answers. On each update of the exam questions, we send an email to users to re-download the files. |

| Question: Can I obtain updated CPA-REG practice tests? Answer: Yes, you can obtain up to date and 100% valid CPA-REG practice test that you can use to memorize all the Dumps and practice test as well before you face the actual test. |

| Question: We want to do group studies, Do we need multiple licenses? Answer: Yes, you should buy one license for each person, or a bulk license that can be used in a group. That is very cheap. Contact sales or support for details about bulk discounts. |

| Question: Do you recommend me to use this great source of actual CPA-REG test questions? Answer: Yes, Killexams highly recommend these CPA-REG test questions to memorize before you go for the actual exam because this CPA-REG examcollection contains an up-to-date and 100% valid CPA-REG examcollection with a new syllabus. |

| Question: Do I need to read and practice all the questions you provide? Answer: Yes, you should read and practice all the questions provided by killexams. The benefit to read and practice all CPA-REG test prep is to get to the point knowledge of exam questions rather than going through huge CPA-REG course books and contents. These questions contain actual CPA-REG questions and answers. By reading and understanding, complete examcollection greatly improves your knowledge about the core Topics of CPA-REG exam. It also covers the latest syllabus. These exam questions are taken from CPA-REG actual exam source, that's why these exam questions are sufficient to read and pass the exam. Although you can use other sources also for improvement of knowledge like textbooks and other aid material these questions are sufficient to pass the exam. |

https://www.pass4surez.com/art/read.php?keyword=AICPA+2024+PDF+questions&lang=us&links=remove

Whilst it is very hard task to choose reliable exam Dumps resources regarding review, reputation and validity because people get ripoff due to choosing incorrect service. Killexams make it sure to provide its clients far better to their resources with respect to quiz test update and validity. Most of other peoples ripoff report complaint clients come to us for the brain dumps and pass their exams enjoyably and easily. We never compromise on our review, reputation and quality because killexams review, killexams reputation and killexams client self confidence is important to all of us. Specially we manage killexams.com review, killexams.com reputation, killexams.com ripoff report complaint, killexams.com trust, killexams.com validity, killexams.com report and killexams scam. If perhaps you see any bogus report posted by our competitor with the name killexams ripoff report complaint internet, killexams.com ripoff report, killexams.com scam, killexams.com complaint or something like this, just keep in mind that there are always bad people damaging reputation of good services due to their benefits. There are a large number of satisfied customers that pass their exams using killexams.com brain dumps, killexams PDF questions, killexams practice questions, killexams exam simulator. Visit our test questions and sample brain dumps, our exam simulator and you will definitely know that killexams.com is the best brain dumps site.

Which is the best practice questions website?

Yes, Killexams is 100% legit together with fully trusted. There are several features that makes killexams.com real and straight. It provides knowledgeable and 100% valid exam questions containing real exams questions and answers. Price is minimal as compared to many of the services online. The Dumps are refreshed on ordinary basis having most accurate questions. Killexams account set up and product or service delivery can be quite fast. Report downloading is actually unlimited and intensely fast. Service is avaiable via Livechat and E-mail. These are the features that makes killexams.com a sturdy website that supply exam prep with real exams questions.

Is killexams.com test material dependable?

There are several Dumps provider in the market claiming that they provide actual exam Questions, Braindumps, Practice Tests, Study Guides, cheat sheet and many other names, but most of them are re-sellers that do not update their contents frequently. Killexams.com is best website of Year 2025 that understands the issue candidates face when they spend their time studying obsolete contents taken from free pdf obtain sites or reseller sites. Thats why killexams.com update exam Dumps with the same frequency as they are updated in Real Test. exam questions provided by killexams.com are Reliable, Up-to-date and validated by Certified Professionals. They maintain examcollection of valid Questions that is kept up-to-date by checking update on daily basis.

If you want to Pass your exam Fast with improvement in your knowledge about latest course contents and Topics of new syllabus, We recommend to obtain PDF exam Questions from killexams.com and get ready for actual exam. When you feel that you should register for Premium Version, Just choose visit killexams.com and register, you will receive your Username/Password in your Email within 5 to 10 minutes. All the future updates and changes in Dumps will be provided in your obtain Account. You can obtain Premium practice test files as many times as you want, There is no limit.

Killexams.com has provided VCE practice test Software to Practice your exam by Taking Test Frequently. It asks the Real exam Questions and Marks Your Progress. You can take test as many times as you want. There is no limit. It will make your test prep very fast and effective. When you start getting 100% Marks with complete Pool of Questions, you will be ready to take actual Test. Go register for Test in Exam Center and Enjoy your Success.

2V0-81.20 exam cram | 301b Test Prep | 499-01 Latest Questions | LFCS questions obtain | 4A0-M02 mock questions | QV_Developer_11 free questions | CIMAPRA17-BA1-1-ENG exam questions | HIO-301 Dumps | PL-300 exam tips | AHM-540 practice test | RDN free pdf | MD-101 test prep | ACSB-D8 mock questions | 2B0-100 practice test | DCAD past exams | CGRN cram | CCSA Free PDF | PHR exam prep | MCAT practical test | A8 exam test |

CPA-REG - CPA Regulation (REG) 2024 test

CPA-REG - CPA Regulation (REG) 2024 exam help

CPA-REG - CPA Regulation (REG) 2024 exam help

CPA-REG - CPA Regulation (REG) 2024 Latest Topics

CPA-REG - CPA Regulation (REG) 2024 outline

CPA-REG - CPA Regulation (REG) 2024 premium pdf

CPA-REG - CPA Regulation (REG) 2024 Premium PDF

CPA-REG - CPA Regulation (REG) 2024 book

CPA-REG - CPA Regulation (REG) 2024 exam questions

CPA-REG - CPA Regulation (REG) 2024 exam format

CPA-REG - CPA Regulation (REG) 2024 exam format

CPA-REG - CPA Regulation (REG) 2024 practice tests

CPA-REG - CPA Regulation (REG) 2024 exam Questions

CPA-REG - CPA Regulation (REG) 2024 exam syllabus

CPA-REG - CPA Regulation (REG) 2024 Latest Topics

CPA-REG - CPA Regulation (REG) 2024 test prep

CPA-REG - CPA Regulation (REG) 2024 Practice Questions

CPA-REG - CPA Regulation (REG) 2024 Free PDF

CPA-REG - CPA Regulation (REG) 2024 practice tests

CPA-REG - CPA Regulation (REG) 2024 exam success

CPA-REG - CPA Regulation (REG) 2024 study help

CPA-REG - CPA Regulation (REG) 2024 exam

CPA-REG - CPA Regulation (REG) 2024 questions

CPA-REG - CPA Regulation (REG) 2024 testing

CPA-REG - CPA Regulation (REG) 2024 guide

CPA-REG - CPA Regulation (REG) 2024 Practice Questions

CPA-REG - CPA Regulation (REG) 2024 study help

CPA-REG - CPA Regulation (REG) 2024 answers

CPA-REG - CPA Regulation (REG) 2024 exam

CPA-REG - CPA Regulation (REG) 2024 Latest Topics

CPA-REG - CPA Regulation (REG) 2024 study tips

CPA-REG - CPA Regulation (REG) 2024 Question Bank

CPA-REG - CPA Regulation (REG) 2024 Practice Questions

CPA-REG - CPA Regulation (REG) 2024 test

CPA-REG - CPA Regulation (REG) 2024 questions

CPA-REG - CPA Regulation (REG) 2024 exam

CPA-REG - CPA Regulation (REG) 2024 Latest Questions

CPA-REG - CPA Regulation (REG) 2024 testing

CPA-REG - CPA Regulation (REG) 2024 study help

CPA-REG - CPA Regulation (REG) 2024 study help

CPA-REG - CPA Regulation (REG) 2024 testprep

CPA-REG - CPA Regulation (REG) 2024 study help

CPA-REG - CPA Regulation (REG) 2024 information source

CPA-REG - CPA Regulation (REG) 2024 exam success

Other AICPA Practice Tests

PCEP-30-01 writing test questions | CPA-REG practical test | CPA-AUD exam Questions | PCAP-31-03 test prep questions | ABV exam cram | FAR pdf study guide | BEC exam cram |

Best practice questions You Ever Experienced

D-PSC-DS-23 sample test questions | SOA-C02 cram | PEGACPMC84V1 questions answers | SABE501V3-0 exam prep | C1000-043 PDF Download | F50-522 exam questions | H13-711_V3.0-ENU free pdf download | Javascript-Developer-I test prep | AI-900 examcollection | MS-700 Study Guide | ISFS mock test | 156-585 Practice Questions | MS-100 Free exam PDF | NSE6_FNC-8.5 test example | VCS-260 practice test | BONENT-CHN Study help | CIA-I pdf download | VCS-413 free questions | 5V0-21.21 exam test | H35-462 cram book |

References :

https://killexams-posting.dropmark.com/817438/23717653

http://killexams-braindumps.blogspot.com/2020/07/here-is-pass4sure-cpa-reg-exam-dumps.html

https://www.instapaper.com/read/1324031943

https://drp.mk/i/12B8p80cSM

https://sites.google.com/view/killexams-cpa-reg-questions

https://files.fm/f/fu2tbu6ma

https://youtu.be/PfKI_cliW_g

https://www.coursehero.com/file/84056490/CPA-Regulation-CPA-REGpdf/

http://feeds.feedburner.com/PreciselySameCpa-regQuestionsAsInRealTestWtf

Similar Websites :

Pass4sure Certification exam Practice Tests

Pass4Sure Certification Question Bank